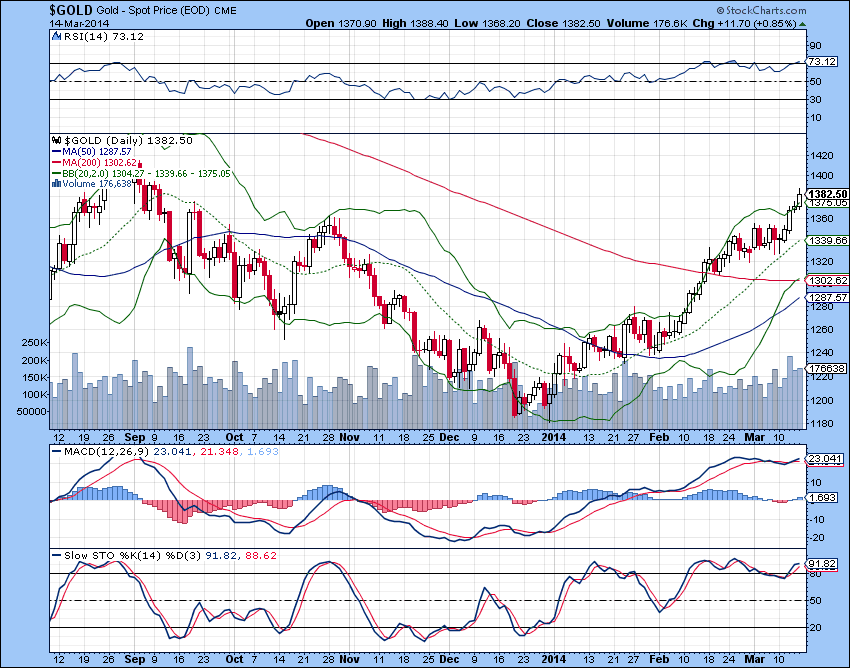

Gold has completed The Golden Cross and major Bullish Reversal is underway after this "FOMC week" correction. Now we should move much higher and Goldman Sachs with its call for Gold $1,050 by the end of the year is the very good contrarian indicator.

By the way, very interesting situation was happening today with McEwen Mining. Somebody from Goldman Sachs was all over the bids and MUX was traded with total volume of 20.7 million shares and Up 8%. (Update: Now with all after hours trades accounted the total volume between NYSE and Toronto stands at 30.8 million shares vs average volume of 3.5 million shares). That Somebody was caught Very Short after McEwen Mining run this year up to $3.74 and this "FOMC Week" That Somebody was "coincidentally happy" with MUX hitting low of $2.66 before very strong rebound and close at $2.88. Can we talk about manipulation again? One trade was particularly notable in the after hours: at 16.32 9.5 million shares were traded at $2.8804. Last month at the end of February the total short position in MUX was reported at 25.5 million shares, so somebody used this week the opportunity to close at least part of it.

The upgrade from Cowen and Company has added to the fire: McEwen Mining Price Target increases to $4.57. One more reason for the huge volume spike was mentioned as the rebalancing in GDXJ - Junior Miners ETF. We will see in a week time the change in the short position in McEwen Mining to find out the real picture.

Now we have the Volume Buy Signal in McEwen Mining and this rebalancing has coincided very nicely with the "FOMC Week" Gold sell off and shaking the weak hands out of the company stock. We will see what will happen next week and will monitor the Gold Golden Cross media talk this weekend.

The upgrade from Cowen and Company has added to the fire: McEwen Mining Price Target increases to $4.57. One more reason for the huge volume spike was mentioned as the rebalancing in GDXJ - Junior Miners ETF. We will see in a week time the change in the short position in McEwen Mining to find out the real picture.

Now we have the Volume Buy Signal in McEwen Mining and this rebalancing has coincided very nicely with the "FOMC Week" Gold sell off and shaking the weak hands out of the company stock. We will see what will happen next week and will monitor the Gold Golden Cross media talk this weekend.

Small change games around TNR Gold could be ended in tears for the "players" as well very soon. The penny stock was sold into 3 cents on no volume again today. Next move in McEwen Mining and very strong announcements from International Lithium this week will change the picture very fast, TNR Gold holds 25.5% In International Lithium, shares of McEwen Mining and back-in right into Los Azules Copper project with McEwen Mining.

Eric Sprott - Gold To See Powerful Bullish "Golden Cross" Within Days TNR.v MUX GDX GDXJ GLD ABX NG

C.S. Eric Sprott is talking about the "Golden Cross" - the very powerful bullish signal coming for Gold within the next few days. On the chart above you can see the very strong first move of the new Bull market in Gold from the December 2013 low. We are just 2% from 20% increase when media will start talking about the new Gold Bull market being "confirmed officially." As you can see MA 50 is turning decisively Up and is ready to cross MA200 to the upside.

The very important driving forces behind this Gold rally is the record buying from China and the ongoing Gold Manipulation investigations. Eric thinks that all major bullion banks are at risk now and their compliance departments are very busy trying to manage the damage of potential litigation and fines. "The most important here that this process removes the manipulators out of the market. The ceiling is taking off from the Gold price now, they can not continue to manipulate Gold market as they did any more"

You can listen to Eric on the link below and we will run a few charts showing what "Golden Cross" means for particular stocks.

We have discussed the "Golden Cross" for McEwen Mining a few weeks ago and you can see the performance of that company this year. The stock is in a clear breakout mode fuelled by the Gold breakout and the powerful short squeeze. We expect TNR Gold to join this party after the Gold "Golden Cross" will ignite mass media talk that the Gold Bull Is Back.

Massive Short Squeeze Drives McEwen Mining Higher On Solid Results MUX TNR.v GDX GDXJ GLD HUI

"McEwen Mining has delivered solid results in 2013, updated its resource estimates at the San Jose mine in Argentina and Gold breakout now drives the stock higher on the massive short squeeze this week. According to NASDAQ, McEwen Mining Short Interest was at 25.5 million shares in the end of February. Solid operational results, higher Gold and Silver prices are making shorts very nervous these days. Catalyst will come with the news from Nevada exploration program, El Galo 2 development with higher Silver prices and any Los Azules copper development can change the situation for McEwen Mining and TNR Goldovernight."

McEwen still hopeful of attracting a buyer for Los Azules

Silver is very close to print its own "Golden Cross" on the chart above. It took longer for Silver to consolidate than for Gold and now we have the very bullish formation of Cup and Handle. Next move in Gold above $1,420 - the previous High in the Double Bottom 2013 formation - will bring the major force to move Silver much higher after its "Golden Cross" will be in place.

Junior Gold Miners ETF GDXJ shows the similar print. The Volume is rising this year in the sharp contrast to the last year, more money is coming in search for the higher leverage to the Gold price. GDXJ is very close to print its own "Golden Cross" as well. It is in a very powerful recovery mode as well and is breaking out of the Bullish Cup and Handle formation. Mass media talk that The Gold Bull is Back will highlight the stronger junior miners with promising projects which were sold into the dust last year.

Gold Miners ETF GDX is very close to print its own "Golden Cross" as well. It is in a very powerful recovery mode as well and is breaking out of the Bullish Cup and Handle formation.

US Dollar on the chart above is very weak and the news about 100 Billion in US Treasuries being sold last week are not helping it. The ongoing Financial War USA vs Russia and China around Syria and Ukraine accelerates the De-Dollarisation as never before.

Paul Craig Roberts: US is Completely Busted, Non-Delivery of Gold - Crash the System, War in Ukraine TNR.v MUX GDX GLD

"Gold is above $1,370 today and US Dollar is testing another low of 79.30. Paul Craig Roberts is pouring very cold water on the hot heads from the "DC Command Centre". All these War games can be ended in the very real tears, world is too much interconnected today in order just to punish "the bad guy". Somebody wants the War too bad with any excuse and it is not the good idea at all. Ongoing Financial War already distorting the markets and U.S. recovery is too weak to handle and further external shocks. The very least what BRICS can do now is they will speed up their De-Dollarisation plans."

Please Note our Legal Disclaimer on the Blog, including, but Not limited to:

There are NO Qualified Persons among the authors of this blog as it is defined by NI 43-101, we were NOT able to verify and check any provided information in the articles, news releases or on the links embedded on this blog; you must NOT rely in any sense on any of this information in order to make any resource or value calculation, or attribute any particular value or Price Target to any discussed securities.

We Do Not own any content in the third parties' articles, news releases, videos or on the links embedded on this blog; any opinions - including, but not limited to the resource estimations, valuations, target prices and particular recommendations on any securities expressed there - are subject to the disclosure provided by those third parties and are NOT verified, approved or endorsed by the authors of this blog in any way.

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advice on this blog and there is no solicitation to buy or sell any particular company.

No comments:

Post a Comment