Rob McEwen is in demand now about his views on Gold with equity bubble being challenged last few days. Market manipulations can not be run forever and reality will be settling in at some point. This time can be very close now with Durable Goods report out at - 4.3% (!) in December vs 2.6% in November. Last Jobs Number disaster can be not so "out of range' now as the bubble Media would like us all to think. Gold is at the very important juncture now and decisive move above $1270 will create the short covering fireworks.

Rob continues to innovate even in the tough markets, has appointed the very young and promising Ian Ball as President and now even launched his own drone at El Galo 1! We hope that now he can see the best strategy for the world class Los Azules Copper deposit to realise its value for McEwen Mining and TNR Gold.

McEwen Mining El Gallo Test Drone

Rob McEwen On Goldcorp's Hostile Bid, M&A Opportunity And Market Bottoms MUX, TNR.v, GLD, GDX

Drilling at Grass Valley, southwest of Barrick's Cortez Mine in Nevada, started this week!#MUX#Nevada#drilling pic.twitter.com/WqztoHzpx5

With general equity markets sliding into the territory which will challenge Bernanke's Happy Exit with Tapering, time is to listen to those who have seen and have done it. Rob McEwen is dissecting the recent market situation in Gold and M&A activity, which will make the best stories in the market to move very fast from the bottom. McEwen Mining has bottomed at $1.65 in December and has closed at $2.63 last Friday. Los Azules Copper project will be the one of the coming M&A stories this year, which will move valuations of McEwen Mining and TNR Gold. TNR Gold holds shares of McEwen Mining after the settlement on Los Azules. Rob McEwen has announced on Twitter about the commencement of drilling in Nevada now. With Gold crossing $1270 and closing just below it we have a very exciting time for the best stories in junior mining these days."

McEwen Mining Receives Final Environmental Permit for Construction and Operation of El Gallo 2 Project MUX, TNR.v, GDX

"Rob McEwen is on track with development of El Galo 2 and now, after the last main permit has been granted by Mexican authorities, the only question remains where the capital will come from. McEwen Mining had a very impressive run from December $1.65 low to the recent highs of $2.63. Los Azules Copper development remains the major catalyst for McEwen Mining in case of sale of this asset and it will make development of the existing pipeline of project feasible and further acquisitions will bring the dreams about S&P 500 back."

McEwen Mining And TNR Gold: China Lights the Way for Copper MUX, TNR.v, GDX, CU

"Nobody loves miners any more - it could be the very good time to accumulate the best stories in the market place. And now it looks like that December was a really good time for it. Still under the radar screens of the mainstream investors best junior miners are turning around from historical oversold levels. Last week CITI went bullish on miners for the first time in three years, so the story will be getting out and new money will be coming into the sector now.

McEwen Mining has been breaking out with the very impressive run from retesting lows of 2013 at just above $1.65 level in mid December to this last Friday close of $2.49 on Volume of 5 million shares. TNR Gold is getting its bids as well now and closed at CAD0.055 last week. Los Azules copper is the key to valuation catalyst for both companies now. TNR Gold holds shares of McEwen Mining after the settlement on Los Azules. TNR Gold is selling its Back-In right with PI Financial engaged and Rob McEwen was relying on Los Azules sale to finance its ambitious expansion plans.

In the recent interview Rob has discussed Argentina situation, which is changing for the better now. Nothing is easy in these markets, but any developments with Los Azules will be the game changer for McEwen Mining and TNR Gold. Rob is talking about potential acquisitions for McEwen Mining, ongoing drilling in Nevada in Q1 and his conversation with "person from the ground in China." Not a lot of people are expecting it, but 5 dollar Copper could be in the cards, according to that source. Needless to say that it will make very happy shareholders of McEwen Mining and TNR Gold and Rob is still standing by his $5,000 price for Gold.

Recent impressive rally in McEwen Mining was fired by the huge short position of over 30 million shares as of December 2013 and should Gold continue its run to the upside shorts will be very nervous. The WSJ article is providing some confirmation of the potential change in the trend for Copper as well."

McEwen Mining And TNR Gold: Report - Argentina Is In The Mood For Change On Investment Policy TNR.v, MUX, LCC.v, SSRI, PAA

"Argentina mining landscape is changing for the better according to the report by BN Americas. Lumina Copper is trading above CAD 6.00, McEwen Mining is breaking out to the upside and TNR Gold has found some bids as well recently."Los Azules Copper - McEwen Mining And TNR Gold: Yamana Gold to invest $450 million in Argentine mine MUX, TNR.v, LCC.v

"It looks like the shift in Argentina for the better is happening for real this time. Rob McEwen has discussed it in his recent presentation and that in his opinion "we have seen the low in Argentina after a lot of disappointment". Shevron special Shale Oil deal, repayment to Repsol and now Yamana Gold investment are certainly the things we would like to see now after elections. Lumina copper is holding above CAD5.00 these days and McEwen Mining and TNR Gold should benefit from Los Azules copper revised valuation now."

Huffington Post:

Will Gold Soar on the Dow Drop?

What's bad for the Dow is great for gold. Last week, the Dow Jones Industrial Average dropped over 600 points, sparking a Gold Bug swoon. Gold prices polished up two percent, while McEwen Mining, a junior gold mining company, popped 10 percent.

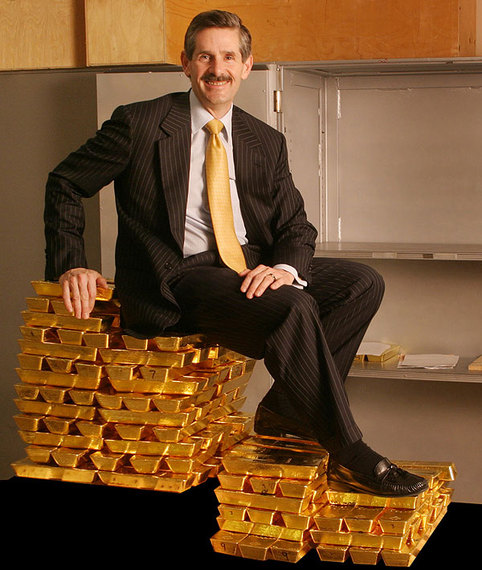

Rob McEwen, the executive chairman and chief owner of McEwen Mining has been in the gold mining business for 25 years. Under his leadership, Goldcorp grew from a market capitalization of $50 million to over $8 billion. So, I turned to him for wisdom and experience on today's dance between the Dow and gold.

Natalie Pace: What happened to gold in 2013? Has gold hit a low? Where will prices go in 2014? What's in your crystal ball?

Rob McEwen: Gold certainly fell out of favor in late 2012 and all of 2013; however, the reason for owning gold hasn't gone away. There are still large levels of debt and currency issues.

NP: What happened? Who was doing all of that selling? From the stats I saw, it was almost exclusively exchange-traded funds.

RM: There was a great deal of selling in the paper market, in the derivatives. You saw strange occurrences where the value of gold in the exchange-traded funds was dropping very quickly, while the physical market was trading at a premium. There was very big buying happening in Asia -- principally in India for awhile, and in Hong Kong for the Chinese market. They've remained large buyers of gold.

NP: Where are gold prices headed?

I think gold this year has a chance to test the highs that it achieved back in 2011, which would be just above $1900 an ounce. Beyond that, I believe that we are going to see a $5000/ounce gold price in the next couple of years. For someone who is a contrary investor, it's a good time to be looking at gold. I think gold stocks more so because they've been so beaten up in this market.

NP: You have a very ambitious goal of getting a listing on the S&P 500 by 2015. Are you still on track for that? What do you need to get there?

RM: We might be a little delayed to get there by the end of 2015. In order to qualify for the S&P 500, you need to have a $5 billion plus market capitalization. Our market capitalization is a little more than a tenth of that right now. We need more production. I'd prefer to see it organically. But that's not possible in the next two years to get that type of growth.

NP: Why do you have such a strong focus on getting the S&P 500 listing?

RM: The attraction of the S&P 500 is that there is only one gold stock there and that is Newmont Mining. There are over a trillion dollars invested by index funds in the S&P 500. So, you have a large pool of capital. You have long-term investors, and you have a lower cost of capital when you are in that index, which allows you to grow faster and cheaper than your competition. And the only way to get into the S&P 500 is by being an American company. Most of the mining companies, particularly in the precious metals space, are Canadian, Australian, or non-American. There wouldn't be more than a handful of companies that would have a shot at getting into that space. It's a competitive advantage we have.

NP: You focus on exploration, in addition to production. Please tell us how exploration helped you build shareholder value at your previous company, Goldcorp.

RM: It worked very well. We found more than six million ounces of gold in a mine and made the mine a very profitable enterprise. We launched our [Goldcorp] contest back in 2000. We spent about a million dollars -- half a million in prizes and half a million setting it up. And we found three billion dollars worth of gold.

NP: How are you identifying your exploration targets today?

Right now, we're exploring in Nevada, joint ventured with a company [that] measures the quantity of gold in the water in parts per trillion. When you get an elevated level of gold, that's not a bad target to be drilling on. So, we're going to be drilling this first quarter on a target there and a couple of targets around our property. What makes it interesting is that 10 miles away is the largest gold mine in the world that is run by Barrick Gold.

NP: You've been hoping to capitalize on your Nevada land since the inception of U.S. Gold? How have previous exploration attempts gone, and what is different this time?

RM: We were looking for deeper targets. We didn't find anything on our Tonkin Property. But at the south end of that property, we're reactivating a mine with a permit that we're hoping to get by the first quarter of 2015. It's a low capital build, low cost, eight-year life operation.

[Exploration] drove Goldcorp's success in the early days. The value you create can be very dramatic when you hit.

NP: Exploration costs money. How is McEwen Mining positioned in terms of capital? Will you need to raise money in the debt markets? Are you going to have to pull out your wallet again?

RM: In terms of this year, our expansion of our one gold mine in Mexico, that's taken care of. We're about $30 million in cash right now. We don't have any debt. We have talked to some lenders about putting a small amount of leverage on the balance sheet, but I'm not a big believer in levering up the balance sheet very much. With regard to our large Mexican property, right now, given the price of gold and the lack of enthusiasm in the market, I'm not anxious to run out and do a financing.

NP: How is the cash flow? Are you starting to generate some free cash, are you breaking even, or are you in cash burn?

RM: Our all-in costs are around $1100/ounce. This year, if metal prices stay where they are, we would maintain our cash, which is about $30 million. To build our next big project, we'd have to go find a source of capital, either debt or debt and equity, or through a combination of another company that has free cash. We will in 2016 or 2017 have considerable cash flow on our models. It should be a very positive situation.

NP: We saw some very dramatic price swings in the McEwen Mining share price in 2013. Will that continue to be the case? Or is this the beginning of better days to come?

RM: Our production is moving from 140,000 thousand ounces of gold this year -- up 33 percent from last year. This year will be flat. Then 2015 will be 175,000. With the new mine in Nevada, we'll be above 225,000. With the new mine in Mexico, we'll need some money to build that one, but we'd be over 300,000 ounces a year in gold and silver. So, I'm quite excited about that.

NP: And that doesn't include your copper reserves in Argentina, or anything that you might discover in your exploration.

RM: There will be discoveries that seem to come out of the blue. They are going to happen by smaller companies that have been working away and are ignored by the market.

NP: Last week, the contrarian dance between the Dow and gold was as dynamic as ever - perhaps surprising investors who had given up on gold.

You can have some very dramatic moves. In August of last year, we saw the gold market look like it was coming alive for a moment. In juniors and mid-sizes, and even the seniors, we saw movements of 25 percent to 75 percent gains within the month of August. They gave up those gains in September, but what it illustrated for me was that when people start moving back into gold, it's not going to be a slow run-up. There are going to be some very explosive jumps in value that are going to surprise most people because they have ignored the sector. From the lows of July last year, we got down to about $1.60 and we're now trading at [$2.60]. It may seem like a big move, but it's still a distance from the highs that were achieved when gold went up to $1900. So, I think you're going to see some very strong runs in gold stock."

Please Note our Legal Disclaimer on the Blog, including, but Not limited to:

There are NO Qualified Persons among the authors of this blog as it is defined by NI 43-101, we were NOT able to verify and check any provided information in the articles, news releases or on the links embedded on this blog; you must NOT rely in any sense on any of this information in order to make any resource or value calculation, or attribute any particular value or Price Target to any discussed securities.

We Do Not own any content in the third parties' articles, news releases, videos or on the links embedded on this blog; any opinions - including, but not limited to the resource estimations, valuations, target prices and particular recommendations on any securities expressed there - are subject to the disclosure provided by those third parties and are NOT verified, approved or endorsed by the authors of this blog in any way.

Please, do not forget, that we own stocks we are writing about and have position in these companies. We are not providing any investment advice on this blog and there is no solicitation to buy or sell any particular company.

Rob McEwen

Rob McEwen

No comments:

Post a Comment