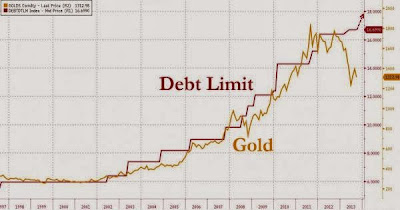

It is time to repost our entry with Jim Puplava and find out the implications of the nomination of Janet Yellen to the FED. We can expect the Gold price to be under pressure to impose the false interpretation of extremely bullish fundamentals, but this manipulation will end with the real fireworks in this sector. Debt ceiling increase will happen after all this political posturing and new Chairperson will be even more accommodative in its polices based on Michael Woodford's narrative.

Jim Puplava: Janet Yellen to the Chair And Michael Woodford Is The New FED's Play Book. GLD, GDX, MUX, TNR.v

Bloomberg: Central bankers around the globe look to the economic theories of Michael Woodford for extraordinary methods to spur growth when interest rates are already near zero. Photograph: Ryan Pfluger/Bloomberg Markets

Jim Puplava is talking about "FED's Big Flip Flop" in his big picture this week. He is calling for Janet Yellen to be the next Chairperson of the FED. Her dovish monetary policy will be highly beneficial for our Gold Bull. Jim sees the transition from unemployment target to the GDP based target for the FED's monetary policy. Quite surprising in its honesty were two remarks from Bernanke: about unexpected tightening effect on the markets after FED's announcement about the tapering of QE - when interest rates have almost doubled from the spring low. And Ben's admission that unemployment rate does not provide the clear employment picture and is affected the employment participation rate.

Michael Woodford has become the new FED's play book after his monetary theories were widely adopted by the central banks around the world after Jackson Hole in August 2012. You can find his Bloomberg profile here.

Now we have more clues to understand why Eric Sprott is selling Art in order to buy more shares of Gold and Silver mining companies.

Jim Puplava’s Big Picture: The Fed’s Big Flip Flop

Fed Reserve: Yellen Secures Obama NominationPresident Obama is set to confirm Janet Yellen as his choice to succeed Ben Bernanke as chair of the Federal Reserve.

Janet Yellen is a respected economist, bank regulator and lecturer

Male domination of central banking is set to be blown away as a woman is nominated for the most powerful monetary policy position in the world.

President Barack Obama will formally nominate Federal Reserve vice chair Janet Yellen to succeed Ben Bernanke as chairman of the US central bank on Wednesday.

It would make Ms Yellen the first woman to head the Fed.

Mr Bernanke will serve until his term ends on January 31, completing a remarkable eight-year tenure in which he helped pull the US economy out of the worst financial crisis and recession since the 1930s.

Under Mr Bernanke's leadership, the Fed created extraordinary programmes after the financial crisis of 2008 that are credited with helping save the US banking system.

The Fed lent money to banks after credit markets froze, cut its key short-term interest rate to near zero and bought trillions in bonds to reduce long-term borrowing rates.

Ms Yellen, 67, emerged as the leading candidate after Larry Summers, a former Treasury secretary who Mr Obama was thought to favour, withdrew from consideration last month in the face of rising opposition.

A close ally of the current chairman, Ms Yellen is seen as a so-called dove as she has been a key architect of the Fed's efforts to keep interest rates near record lows.

The White House announcement comes amid a confrontation between Mr Obama and congressional Republicans, particularly those in the House, over the partial government shutdown and the looming breach of the nation's $16.7trn borrowing limit.

Mark Zandi, chief economist at Moody's Analytics, said that the administration probably decided to go ahead with the announcement to send a signal of policy stability to financial markets, where investors are growing increasingly nervous over the partial shutdown and what they perceive as the much bigger threat of a default on Treasury debt.

He said: "Markets are very unsettled and they are likely to become even more unsettled in coming days.

"Providing some clarity around who will be the next Fed chairman should help at least at the margin."

As vice chair since 2010, Ms Yellen has helped manage both the Fed's traditional tool of short-term rates and the unconventional programmes it launched to help sustain the economy after the financial crisis.

These include the Fed's monthly bond purchases and its guidance to investors about the likely direction of rates.

Senator Tim Johnson, a Democrat who heads the Senate Banking, Housing and Urban Affairs Committee, which must approve Ms Yellen's nomination, said he would work with the panel's members to advance her confirmation quickly.

"She has a depth of experience that is second to none, and I have no doubt she will be an excellent Federal Reserve chairman," Mr Johnson said.

Sen Chuck Schumer, a Democratic committee member, called her "an excellent choice" and predicted she would be confirmed by a wide margin.

Mr Obama's choice of Ms Yellen coincides with a key turning point for the Fed. Within the next several months, it is expected to start slowing the pace of its Treasury and mortgage bond purchases if the economy strengthens.

While economists saw Mr Obama's choice of Ms Yellen as a strong signal of continuity at the Fed, analysts said the difficult job of unwinding all of the Fed's support without causing major financial market upheavals would fall to her.

Ms Yellen has long been considered a logical candidate for the chairmanship in part because of her expertise as an economist, her years as a top bank regulator and her experience in helping manage the Fed's polices.

Her understanding of the financial system is widely respected: Before the crisis struck, she was among a minority of top economists who had warned correctly that subprime mortgages posed a severe threat."

No comments:

Post a Comment