Jesse reports about the ongoing Game of Musical Chairs in the Western Fractional Reserve Gold System with manipulated LBMA and COMEX Gold markets. With China taking now all physical delivery from the system the entire Western Gold market is under enormous pressure.

We found it very positive that with more unleashed attacks on Gold - in order to redeem physical Gold from GLD ETF holdings - it is more and more difficult for Gold market manipulators to keep it under $1300. Physical demand is pushing the price right back up. Goldman Sachs clients are not doing very well if they Sold their gold below $1300 following the House Gold Sell Call. This week we had a very impressive breakout in Gold, Silver and Gold & Silver mining stocks.

Gold Spikes to $1349.00 - Is Initial Claims Report Leaked Again? GLD, MUX, TNR.v, GDX, SLV

"Gold has spiked to $1349 well before 8.30 am when Initial Claims Report is scheduled to be released. Is the data leaked again?

Update 8.30 am:

All jobs' data is WORSE than expected again. How can we get on that "Early Bird" email list? It is just getting totally ridiculous, is there ANY rule of law left in the U.S.?"

September Nonfarm Payrolls Huge Miss - Gold Spikes Up, Data Leaked Again GLD, MUX, TNR.v, GDX

"We have September Nonfarm Payrolls with the Huge Miss and Gold Spikes Up immediately. Data was leaked yearly again with Gold printing:

+$5 at 8.28 and

+$18 at 8.33

"Cowboys" shorting the Gold market, according to Eric Sprott, must be in a serious trouble now. The yearly trade on October 15th has amounted to 640 million and Gold was Sold at 1270 - 1250 levels. Now with CFTC out of hibernation can we expect at least some kind of investigation?

There are more and more calls about the US Dollar loosing its Reserve Currency of Choice status now. Default was avoided, but the damage is done.

All FIAT currencies are based on trust. The geopolitical shift is making its way to mass media and we are witnessing the groundbreaking developments in the Gold market. Nobody can manipulate it all the time and China will be busy writing "Thank You Cards" to the FED and related Cartel members at LBMA and BIS, buying all the physical Gold available for Delivery at this levels.

All FIAT currencies are based on trust. The geopolitical shift is making its way to mass media and we are witnessing the groundbreaking developments in the Gold market. Nobody can manipulate it all the time and China will be busy writing "Thank You Cards" to the FED and related Cartel members at LBMA and BIS, buying all the physical Gold available for Delivery at this levels.

We can forget about the Taper until mid 2014 now and Janet Yellen will be following the new FED's playbook written by Michael Woodford. Peter Schiff has dissected for this situation very well."

Jesse's Cafe American:

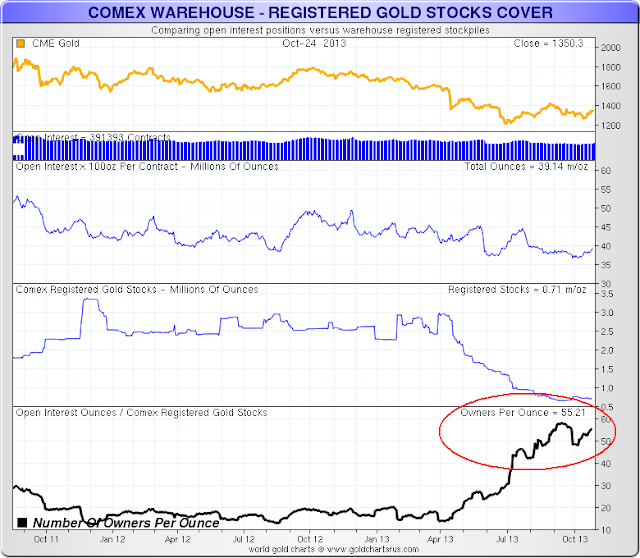

Claims Per Deliverable Ounce Rises Above 55 at These Prices - JPM's Odd Warehouse Deliveries

There was nothing in or out of the Comex warehouses yesterday with regard to gold bullion.

TFMetals had some very interesting observations on recent actions in the Comex, in which JPM brought in two tranches of perfectly even metric tonnes to their warehouse.

Anyone who knows the nature of actual gold bars in use understands that they are never crafted even to the ounce, and certainly not to the tonne.

And one has to wonder where such a large amount of gold was found outside the Comex in 100 oz bars and/or from what refinery it has recently been certified Comex good. Or were the customary requirements waived for some reason on introducing new bullion bars into the Comex complex for them? Are they self-certifying now?

They are on the quantities. As you know, the CME has added a specific disclaimer to their warehouse report that say they perform no audit or inspection whatsoever on what the Banks might report in bullion, and assume no responsibility.

Be all this as it may, the number of claims per ounce of registered metal continues to climb with expanding open interest, and now stands at around 55, which is very high. And about 40 percent of that deliverable gold sits in the JPM managed warehouse.

Given the potential for a dislocation to the exchange, and the widespread gimmickry that has been uncovered with the Banks and their commodity activity, I would like to think that the CME and CFTC might rouse themselves to have a look.

As I recall, someone who is a hero to the markets said, 'trust, but verify.' And the grounds for trust these days are stretched exceptionally thin.

Weighed and found wanting.

Stand and deliver.

No comments:

Post a Comment