The recent Panic and Fear in the market is not something to be taken lightly. According to the chart above - it is only second to the Panic during financial meltdown in 2008 and only slightly higher than we have experienced last year in May.

Some people are talking about today's Sell Off in Gold as a sign that Bernanke "will do nothing" and his "tool box" is empty. We see this "trash Gold operation" as a part of PPT plan to save the market again. Please do not make any mistake - it is not for the sake of investors, at least not ordinary ones with their pension plans - it is for the insolvent financial system in order to keep it running. The falling market in the deflation death spiral with ticking up CDS on all banks, with the stars like Bank of America in the headlines, will make the real financial meltdown is just one policy mistake away.

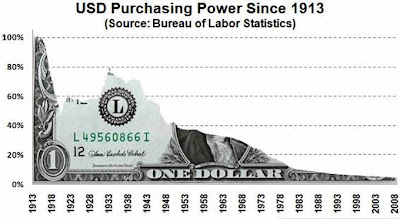

Bernanke has done already everything and will do more just to keep this show running. The only way out is to Inflate the Debt away and debase the currency. This latest Bull Leg in Gold was in all currencies and central banks were buyers themselves. After consolidation we will have the same fundamental picture in place for the Real Store of Value - now we will have the break and another round of reinflation.

This time we should see Gold Major stocks to reflect the value and Juniors will be next in this value play. With panic going down, stock markets will be moving up again pushing fears about "recession" away (we have never come out of it so far if you account the real Inflation from nominal GDP numbers). Oil will be going up again pushing our Lithium ideas on the investors radar screens. If the time for the Energy Transition will be lost we can hit the real wall with Oil prices above 150 dollars and Debts still at the unsustainable levels.

Can we be wrong in our vision - by all means, it is only vision - but the latest news from FED which will be reinstated this Friday by Bernanke - about real negative rates for the years to come - will be driving Real assets higher as all these years before. Nothing is growing to the sky and every parabolic move will be ended in consolidation, but Gold and Silver Bulls still have years to go and New Lithium one is at its very beginning now.

Bernanke has done already everything and will do more just to keep this show running. The only way out is to Inflate the Debt away and debase the currency. This latest Bull Leg in Gold was in all currencies and central banks were buyers themselves. After consolidation we will have the same fundamental picture in place for the Real Store of Value - now we will have the break and another round of reinflation.

This time we should see Gold Major stocks to reflect the value and Juniors will be next in this value play. With panic going down, stock markets will be moving up again pushing fears about "recession" away (we have never come out of it so far if you account the real Inflation from nominal GDP numbers). Oil will be going up again pushing our Lithium ideas on the investors radar screens. If the time for the Energy Transition will be lost we can hit the real wall with Oil prices above 150 dollars and Debts still at the unsustainable levels.

Can we be wrong in our vision - by all means, it is only vision - but the latest news from FED which will be reinstated this Friday by Bernanke - about real negative rates for the years to come - will be driving Real assets higher as all these years before. Nothing is growing to the sky and every parabolic move will be ended in consolidation, but Gold and Silver Bulls still have years to go and New Lithium one is at its very beginning now.

"We all have two choices now - try deflation with the strong dollar, riots on the street and total collapse within few shot years or we will see the coordinated QE3.0 unlished to keep the insolvent financial system running. We have seen the beginning already: Oil release from SPR, SNB and BOJ interventions to prop up the dollar and Run to Treasuries last week. Mother Bear in Treasuries will be continued. After initial panic the dollar will go down - now it will be important to manage its gradual debasement. This is the only way to inflate out Debt, increase Tax revenues without real growth in real Inflation adjusted GDP and make export of US goods and services viable again. We will not be surprised to see the general markets up by the end of the year...in nominal terms. If you would like to know the real picture just check the value of DOW divided by price of Gold. Do not do it with your house price - you will be really depressed.

Once the panic settles we will see flight to the Real assets, China will not be able to diversify all 1.2 Trillion holdings in US Treasuries, but the gradual transition will be in place - new world currency will be the Hard one based on Gold, Silver, Copper and access to strategic commodities like Oil, Lithium and REE. We are expecting that first the gold Majors will properly reflect the Gold valuation in their market caps and after that liquidity will go downstream into the Gold and Silver Juniors. Copper juniors will be at the mercy of the M&A consolidation game again and Lithium will show its truly strategic status with every uptick in the Oil price again.

James Dines can be right on the money again with his calls this time. And we will be honest with you - we just do not know what to do if political circus will bring US to the abrupt end without the proper glory of the Rome Empire in its final days. More"

No comments:

Post a Comment